Demystifying Alberta's Annual Return Requirement for Corporation Registration

If you've registered a corporation in Alberta or are considering doing so, it's essential to understand the ongoing compliance requirements. One crucial aspect of maintaining your corporation's status is the annual return. In this blog post, we'll unravel the mysteries surrounding Alberta's annual return requirement, why it's important, and how to fulfill it.

Personal Service Businesses

Personal Service Businesses (PSBs) are a distinct category of businesses in Canada with unique tax implications. They are defined by the Canada Revenue Agency (CRA) based on specific criteria that differentiate them from other types of businesses. In this blog post, we'll delve into the CRA's criteria for classifying a business as a personal service business and explore the tax implications that come with this classification.

Our Services

WE OFFER: Reliable accounting advice & services for people who own businesses. We also offer personal tax services if you aren't a business owner!

Salary vs. Dividends

Should you be paying yourself a salary or dividends? The answer is... IT DEPENDS. Each business owner has different priorities, and both have advantages and disadvantages. Below are the advantages and disadvantages of both.

How do you pay yourself from the corporation?

How do you pay yourself from the corporation? Did you know it could be a mix of both and it should be based on your business and goals.

What Is A CAPITAL ASSET and why do you need to track them separately for accounting?

What Is A CAPITAL ASSET and why do you need to track them separately for accounting? A capital asset is a purchase which gives a lasting benefit or advantage. The useful life of this purchase exceeds one year and is not intended for sale in the regular course of the operations.

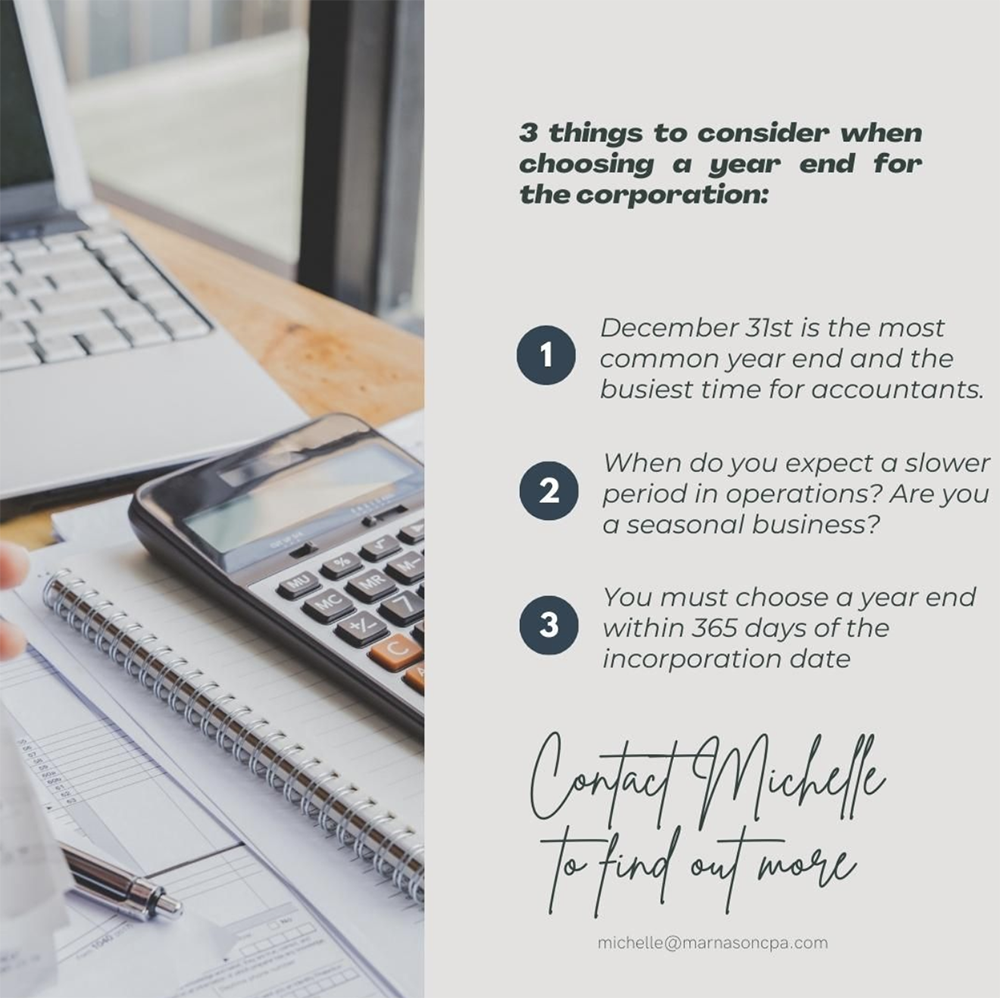

3 things to consider when choosing a year end for the corporation:

Thinking of starting a new business or did you just start one? One of the first steps should always be choosing a corporate year end. The year end can be the last day of any month of the year and there is some key things you should consider before choosing one.